In the local economy Pantai Pasir Putih, credit cards really run our finances; Hence debt management has come of age. The use of credit cards should be limited to necessities and the purchase of luxury goods should be limited, after all we have to pay for it later with interest. The balance of expenses and income is the key.

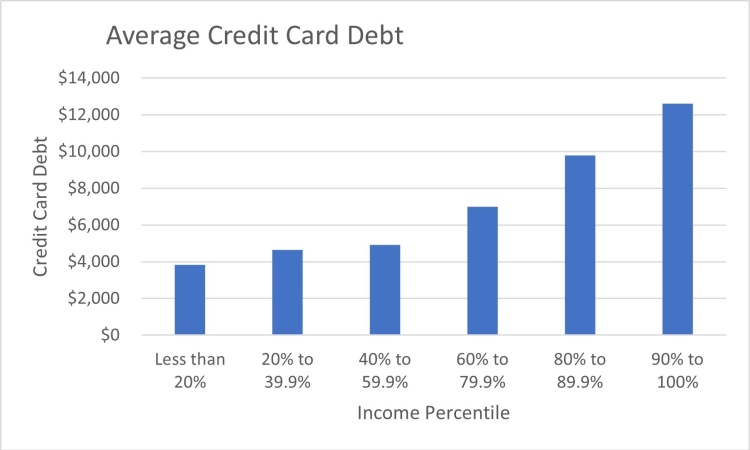

On an average every American consumer incurs a credit debt of 12 % the average credit debt of $ 10,300 per consumer and grown up to $ 11,000 minus mortgages, and the household debt is between $ 18,000 and $21,000. The credit debt needs to be controlled; doing so makes a considerable difference. Some wise thinking and a good judgment helps in bringing down debts. The children need to be educated on paying bills and importance of savings; life without debts is a better way of living. The average credit debt reduction is a possibility, if we take responsibility for our own spending habits.

Here are some guidelines to keep a tab on household debts:

- Pay about 50% of what you make on your debt, as you make more increase by 10%-15%.

- Expenses like food, transportation costs, utilities and expenses needs to be preplanned.

Higher the outstanding debt, lower the credit score, the outstanding debt makes up 30% of this score, payment history makes up another 35%. An unbalanced percentage leads to bankruptcies and foreclosures. In the last 10 years as the average credit debt per American household rose, the amount of bankruptcies doubled.

Credit Card Debt Law

All credit card users are bound by law and must be aware about it. Most users never bother about the law as it is never understood, and believed to be meant for defaulters, but it makes good financial sense to understand it.

Credit card debt law enforces a fair collection of any outstanding debts; it is covered in details by the Fair Debt Collection Practices Act. It explains the legal power a card company uses against you in recovering debts from you. It needs a thought on the law aspect as well. Since 2009 the new credit card laws came into force ensuring protections for consumers, credit card companies can make no undue demands on the rate of interest increment e.g. in case of increased rates on the card, the existing balance still attracts the old rate of interest. The recent charges after the increase will be affected by higher rate.

In the recent times, the new regulations the customers have an option of canceling the cards before the fees are applied, in case of increase in certain fees, unlike previously. Also the cardholders discontinue the use of the card, the card issuer has the right to raise their monthly payments but subject to certain limitations. The customer has the right to terminate the card. The new law protects the new just applied cardholders enabling the customers to enjoy a lower rate of interest for the first year; the introductory rate takes effect after that.